Create a Safety Net of Savings

Finding a job can be a stressful process, and managing your finances during a job search can be difficult. Having a safety net of savings can help you stay afloat and provide you with peace of mind during your search.

Creating a safety net of savings before you start your job search is an important step in managing your finances. Start by setting a goal for the amount of money you want to save. Make sure that it is an achievable goal and that it is realistic for your current financial situation. Additionally, make sure to factor in any unexpected expenses, such as medical costs or emergency car repairs, that may arise during the job search.

Once you have set a goal, create a budget and track your expenses. Keep an eye on your spending and make sure that you are living within your means. Cut out any unnecessary expenses and try to save as much money as you can. Additionally, consider picking up a side job to help you save more money.

Start investing in your savings account as soon as possible. Try to contribute to your savings account on a regular basis and set up automatic transfers from your checking account to your savings account. This will help you to save money without having to remember to make a contribution each month.

Having a safety net of savings to fall back on during your job search can provide you with peace of mind and help you manage your finances. With a bit of planning and budgeting, you can start building your savings today and feel more secure during your job search.

Understand Your Financial Situation

When you’re looking for a job, understanding your financial situation is key to managing your money. Taking stock of your current finances is a great place to start. Look at your income, expenses, and assets. What do you have saved? How much debt do you have? What do you need to pay for each month? Once you have a handle on your current status, you can make a plan for managing your money during your job search.

You’ll want to create a budget and a plan for how you’ll manage your expenses. Start by listing your regular expenses like groceries, rent, and utilities. Then, determine how much you have available to pay for those expenses. You can also look into ways to cut costs. For example, you may be able to take public transportation instead of driving, or you could find a cheaper place to live.

Look into creative ways to make more money. Consider taking on freelance projects or odd jobs to supplement your income while you search for a job. You can also look into ways to make your money work for you, such as investing in stocks, bonds, or mutual funds.

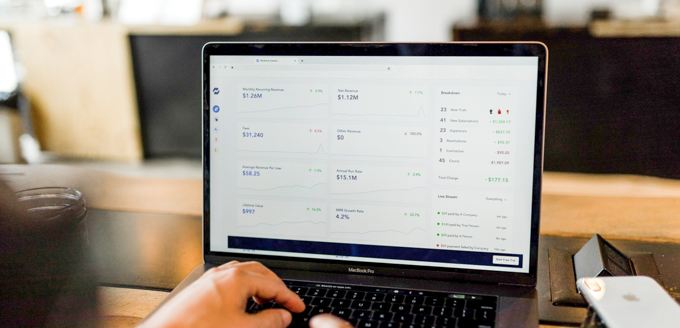

Finally, make sure to keep track of your expenses and income. Setting up a spreadsheet or a budgeting app can help you stay organized and on top of your finances. By understanding your financial situation, you’ll be able to make a plan for managing your money during your job search. With a budget and a few creative solutions, you can make it through your job search without breaking the bank.

Set a Monthly Budget

Financial pressure can be a major source of stress when you are looking for a job. Creating a budget is an important step to help you stay on track with your expenses during a job search. Setting a budget and tracking expenses will help you make sure that you have enough money to cover your essential costs while you are between jobs.

To create a budget, it is important to know how much money you have coming in and how much money you have going out. Start by writing down your total monthly income from all sources, such as unemployment benefits, investments, or freelance work. Then, list your essential expenses, such as rent, utilities, groceries, and transportation. Subtract your total expenses from your total income to determine how much money you have left for other expenses.

Once you have a general idea of how much money you have each month, you can start to create a budget. Break your budget down into categories, such as housing, food, health, and entertainment. Set a realistic amount of money to spend in each category, and make sure to stick to it. You can also use budgeting apps or online tools to help you keep track of your spending.

Creating a budget is a great way to make the most of your money while you are job searching. Setting a budget and tracking your expenses can help you make sure that you have enough money for the essentials and some extra for other expenses. A budget can help relieve financial stress and give you peace of mind—allowing you to focus on the job search.

Prioritize Your Debt Repayment

Paying off debt should be a priority during a job search. It’s easy to put off debt repayment when you’re worried about finances, but doing so is essential to freeing up more of your income for living expenses. You never know how long a job search may take, and it’s important to have a plan in place to handle debt repayment so you can continue to pay your bills.

The first step in debt repayment is to assess your current debt situation. Make a list of all of your debts, including credit cards, student loans, medical bills, and other forms of debt. Then, prioritize your debt by listing them in order of highest interest rate to lowest. This will help you determine which debts you should pay off first.

The next step is to create a budget. Estimate your monthly income and expenses, and use this information to determine how much you can afford to pay off each month. It’s important to set aside some money for living expenses, such as rent and groceries, so you don’t fall behind on those payments.

Once you have a budget in place, you can work on paying off your debt. Consider taking advantage of debt consolidation or balance transfer services so you can get a lower interest rate on your debt and make more progress faster. Additionally, look for ways to increase your income, such as freelancing or taking on part-time work.

Finally, consider setting up automatic payments for your debt. This will help ensure that your payments are made on time and that you don’t miss any due dates.

Prioritizing debt repayment during a job search is essential to managing your finances. By taking steps to assess your debt situation, create a budget, and pay off your debt, you’ll be able to free up more of your income for living expenses and have a better chance of finding a job.

Invest in Your Future

Investing in yourself is an important way to ensure your financial security during a job search. Whether it’s learning a new skill, taking a class, or attending a networking event, investing in yourself can open up new opportunities for job seekers.

Investing in your future can help you to remain marketable even during times of high unemployment. For example, if you are looking for a job in the tech industry, taking a course in coding or software engineering can help you to stand out from the competition. Learning a new skill or knowledge can also help you secure a higher salary or a more fulfilling job.

In addition to investing in your professional development, there are other ways to invest in yourself during a job search. Investing in a professional wardrobe or purchasing a new laptop can help you make a great impression in an interview. Taking steps to update your resume and cover letter can also make you more visible to potential employers.

Investing in yourself also means taking care of your physical and mental health. During a job search, it is important to make time for self-care. Exercise, meditation, and hobbies are all great ways to reduce stress and help you stay motivated during your job search.

The job search can be a rollercoaster of emotions and a financial strain. However, investing in yourself and your future can help you to stay positive and remain confident in your job search. Taking the time to invest in yourself can help you make the right decisions for your future career.

Explore Financial Assistance Options

Exploring financial assistance options is an important part of managing your finances during a job search. It can be a stressful time and the added financial burden can be overwhelming. Knowing what resources are available can provide some much-needed relief during this time.

For starters, look into government programs such as unemployment benefits or disability insurance to determine if you are eligible. Many states also offer loan or grant funding for those who are looking for work. Additionally, unemployment benefits may be available if you were recently laid off or terminated from your job.

Look into any other assistance programs offered by local nonprofits or charities as well. Many of these organizations also provide assistance with job placement, career counseling, and financial assistance. Be sure to research their eligibility requirements and program guidelines before applying.

You may also be able to find assistance from professional associations. These organizations may have grants or scholarships available to those in need of financial assistance while they search for a job. Check with any professional organizations you are a part of or consider joining one to access these resources.

Finally, don’t forget to leverage the power of your network. Ask friends, family, and colleagues if they know of any assistance programs or grants available. You never know who may be able to help.

Exploring financial assistance options can be a great way to manage your finances during a job search. With the right resources and support, you can stay afloat and make it through this difficult time.

Track Your Spending

When you’re looking for a job, it’s important to keep track of your spending. Knowing how much you have coming in and going out every month is essential for making sure you’re staying on budget and avoiding overspending during your job search. With a few simple steps, you can easily track your spending and get a better understanding of your financial situation.

Start by gathering all of your financial documents, such as bank statements, credit card statements, and any other bills or payments you make. Once you have these documents, you can make a list of all your expenses and income. This will help you get a better sense of your spending habits and where your money is going.

If you’re looking for an easier way to track your spending, there are a number of apps and websites that can help. For example, budgeting apps like Mint or YNAB can help you create a budget and track your spending. You can also use spreadsheets or even a pen and paper to list your expenses.

No matter what method you use to track your spending, it’s important to make sure you’re staying on top of it. Make sure you update your budget regularly and check in on it at least once a week to make sure you’re not overspending. Taking a few extra minutes each week to review your expenses can help you make sure you’re staying on track and within your budget.

Managing your finances during a job search can be difficult, but with a little bit of planning and tracking, you can stay on top of your expenses and avoid overspending. Creating a budget and tracking your expenses can help you stay on track and ensure that you have the funds you need to make it through your job search.

Seek Professional Guidance

Finding a financial advisor or a budgeting coach can give you the expert advice you need to manage your money during a job search. While it may be tempting to rely on your own strategies to save money and make ends meet, seeking out a professional who is knowledgeable in these areas can provide a unique and valuable perspective.

A financial advisor or budgeting coach can help you determine what type of budget best fits your needs and can provide you with an actionable plan to ensure that you are making the most of your resources. They can also provide advice on topics such as debt reduction, investments, taxes, and retirement planning. Having an expert on your side can help you make informed decisions about your money and give you peace of mind in knowing that you are taking the right steps to protect your financial future.

Having a professional to guide you in managing your finances during a job search is not just a luxury, but can be a necessity. Whether you are just starting to look for a job or have been unemployed for a while, having an expert by your side can help you make the most of your money. It can also help you stay on track and motivated during your job search.

When looking for a financial advisor or budgeting coach, it’s important to do your research and find someone who fits your needs and lifestyle. Make sure to ask about their qualifications and experience and make sure that they are familiar with the issues you are facing. You should also look for someone who is willing to work with you and provide customized advice that is tailored to your situation.

Finding the right professional to guide you through your job search and manage your finances can be a game-changer. Not only can they provide you with the knowledge and advice you need to make the most of your money, but they can also help you stay on track and motivated during your job search. With the right professional guidance, you can be confident in your financial future and have the peace of mind that comes along with taking the right steps to protect your money.

Be Open About Your Financial Situation

Finding a job can be an intimidating and stressful process. The financial strain that comes with job searching can be overwhelming and daunting, leading to feelings of fear and anxiety. But it doesn’t have to be this way. Being open about your financial situation with friends and family can help you receive the support and advice you need to navigate the job search process.

Talking about money can be uncomfortable, but it can help you take control of your finances and make better decisions about how to manage your funds. Here are some tips for talking about your financial situation with friends and family:

- Take your time. Talk about money when it feels natural and comfortable. There is no need to rush into the conversation.

- Be honest. Be honest about your financial situation and share what you are comfortable with.

- Listen to advice. Once you open up, be prepared to listen to advice and feedback. It’s ok to disagree, but it’s important to take the advice you receive into consideration.

- Show gratitude. Expressing gratitude for their support and advice is key.

In addition to talking to friends and family, there are other strategies you can use to manage your finances during a job search. Here are a few ideas to get you started:

- Create a budget. Create a budget that outlines your income and expenses. This will help you stay organized and on track with your finances.

- Research financial aid. Research and apply for grants, scholarships, and other forms of financial aid to help you cover the cost of job searching.

- Utilize free resources. Take advantage of free resources such as job search websites, career counseling services, and job training programs.

- Cut back on expenses. Cut back on unnecessary expenses so you can focus on the most important ones, such as food and rent.

Managing your finances during a job search can be challenging, but it doesn’t have to be overwhelming. By talking to friends and family about your financial situation and utilizing the tips and strategies listed above, you can make the job search process a bit less stressful.

Take Care of Your Mental Health

Finding a job can be a stressful experience, so it’s important to take care of your mental health while searching. It’s easy to get overwhelmed by the pressures of the job search, so make sure to set aside time for yourself each day. Find activities that relax you and make you feel good, such as going for a walk, reading a book, or talking to a friend.

It’s also important to have realistic expectations for yourself and your job search. You may not hear back from every employer or have a job lined up after a certain amount of time, but that does not mean you’re a failure. Every job search is different, so be kind to yourself and celebrate successes along the way.

In addition to taking care of yourself, you should also stay connected with the people in your life. Talking to friends and family can be a great way to get support and help manage stress. You can also look into joining a job-seeking support group or a networking group to connect with other people who are looking for jobs.

It’s also important to take breaks during your job search as well. Having a regular schedule can help keep you motivated, but it’s also important to take time off to recharge and refocus. Taking breaks can give you a chance to step back and reassess your job search strategy and make changes if necessary.

Finally, don’t forget to thank yourself for the hard work you’re doing. Acknowledge your efforts and be proud of the steps you’re taking to reach your goals. A job search can be a long and difficult process, so make sure to take time to celebrate the milestones and successes.

Remember, taking care of your mental health is just as important as managing your finances during a job search. It’s essential to take time for yourself and practice self-care so that you can stay focused and motivated. With the right attitude and strategies, you’ll be able to navigate the job search and find success.